You think the stock is poised to pop in the near future so you buy next month’s $110 call for $2.27 and sell next month’s $115 call for $0.91. Position delta on a multi-leg order helps traders get a quick read of how much their overall position will move when the value of the underlying stock changes.įor example, let’s say that you enter into a long call spread on shares of Microsoft. That calculation, by the way, is called position delta. On the other hand, if you own that single call option contract that’s the equivalent of 39 shares of Microsoft stock, then you just earned $39 ($1 x 39). If you own 100 shares of Microsoft at $106 per share and it goes up to $107 per share, then you just saw an unrealized gain of $100 ($1 x 100). In the example above with Microsoft, the call option would be like owning 39 shares of Microsoft stock (0.39 x 100) and the put option would be like shorting 43 shares of Microsoft stock (-0.43 x 100). That gives you just 1 share of stock (.01 x 100).

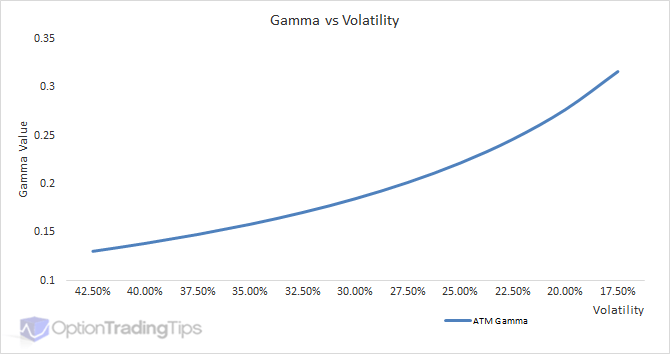

So you need to multiply the delta by 100 shares. Remember, though, options are traded in blocks of 100 shares. Why? Because if the stock goes up by $1, then the call should go up by $0.01 (.01 x $1). 01 is the same as owning a single share of stock. Here’s how that works: a call option with a delta of. Some traders look at delta as a substitute for owning (or shorting) shares of stock. Number of Shares: Another Way of Looking at Delta The price won’t move much just because the underlying stock goes up or down by $1. On the other hand, options that are way out of the money usually have tiny deltas. The measurement of that change is called gamma.įor call options, the delta moves closer to 1.0 as the underlying stock gets further in the money.įor put options the delta moves closer to -1.0 as the underlying stock gets further in the money.Īs a rule of thumb, options that are well into the money move on an almost 1:1 (call options) or 1:-1 (put options) basis with the underlying security. How Delta Changes With the Underlying Stock Priceĭelta itself changes with the underlying stock price. There’s also a difference in the value range between call options and put options.įor call options, the delta ranges from 0 to 1.įor put options the delta ranges from -1 to 0. If shares of Microsoft rise by $1, then you would expect the value of that put option to decrease by $0.43 ($1 x -0.43). That’s important and expected with a put option. Note the negative sign in front of the delta. Next month’s $105 put option delta is -0.43. How much it drops is determined by the delta. So when the stock price goes up, the value of the put option should drop. They’re similar to a short position on the underlying stock. Why? Think about it: put options increase in value as the stock price goes down. Put options deltas are measured as negative numbers. Keep in mind: call option deltas are measured as positive numbers.

That means if shares of Microsoft go up $1, then the call option will increase by $0.39 ($1 x 0.39) or 39% of the value of the change in the stock price. Next month’s $110 call option has a delta of 0.39. Let’s say that Microsoft is currently trading at $106 per share. It tells you how much the value of an option will change when the underlying stock moves higher by $1. You can think of delta as a ratio or a percentage. In this guide, I’ll explain delta so that you can use it to manage risk when trading options. In other words, just because the delta is 0.65 when the stock price is at $50 per share, that doesn’t mean the delta will be at 0.65 when the stock price is at $55 per share. Other Greeks include theta, vega, and gamma.Īs is the case with many other Greeks, delta changes with the underlying security. How much does an option change in value as its underlying stock price moves one way or the other? The answer to that is the delta calculation.ĭelta is one of “the Greeks.” Those are statistical values that give you important info about options.

0 kommentar(er)

0 kommentar(er)